By Armen Vartian | April 06, 2012 9:59 a.m.

Article first published in 2012-04-16, Expert Advice section of Coin World

Seek professional consultation

Individuals can gain tax advantages by owning coins as investments. Net income from the sale of art and collectibles is taxable, but not until the item is sold or otherwise disposed of for value.

For some people, this makes coins a preferred investment vehicle over stocks, whose dividends are taxed annually even if they are in the form of new stock and not cash.

A coin investor can defer taxable gains until a time of his or her own choosing. However, “collectibles,” which includes art and precious metals, are taxed at a rate higher than that for capital assets such as stocks and real estate, which is a disadvantage.

Specialized advice

I recommend specialized advice from financial professionals there.

The key income tax aspects of purchases and sales of art and collectibles relate to the treatment of expenses and losses, and depend largely upon whether you are a collector, an investor or a dealer for tax purposes.

Sounds simple enough, but many people spend a lot of time and effort arguing with the IRS and state taxing authorities over this characterization, because the tax consequences of each can be quite different.

Collectors, who buy and sell coins primarily for personal pleasure, are the most tax-disadvantaged class. They must pay tax on income they earn from their collections, but cannot deduct net losses they might have from collectible sales.

They cannot deduct any expenses relating to their collection, such as insurance, security, membership dues for collectors’ clubs and subscriptions to relevant periodicals, but can offset these expenses against any net income they declare from the sale of items from their collections.

Unfortunately, even this benefit is substantially limited because it comprises a “miscellaneous” itemized deduction on Schedule A subject to the 2 percent adjusted gross income floor.

In other words, unless the collector’s total miscellaneous expenses exceed 2 percent of adjusted gross income, there is no benefit.

Investors fare slightly better. They can deduct expenses relating to their art and collectibles portfolios, but not net losses from sales.

However, the IRS makes it more and more difficult to qualify as an investor, clearly preferring to characterize everyone interested in art and collectibles as a collector.

Fun or profit?

The key is whether the taxpayer is engaged in the activity for profit or for enjoyment. Taxpayers who show a profit from their activities for three of the past five years are presumed to be engaged in those activities for profit, although the IRS has the right to rebut that presumption. Relevant factors are the amount of time the taxpayer spent on the activity, whether the taxpayer relied on advice of experts and whether losses could be expected in a particular year (such as when the market drops in particular types of art or collectibles).

Finally, taxpayers who can establish that they buy and sell art or collectibles as part of a trade or business may acquire dealer status, enabling them to deduct expenses as well as net losses against their other income.

As one might expect, the IRS is loath to treat a collector with other sources of income as a “dealer.”

However, over the years, the regulations in this area have been expanded so that it is not impossible for a serious enthusiast to qualify.

The “for profit” determination is similar to that described above for investors. Dealers pay tax at ordinary income rates and may use losses to offset other ordinary income.

It’s always best to get professional help with tax matters.

Owning Gold and Precious Metals in Taxable Accounts

Bischoff: Before jumping in to precious metals, be sure to get your tax facts straight. By Bill Bischoff (November 29, 2011) www.smartmoney.com

With the safest fixed-income investments–CDs, Treasury bonds, and money-market funds—paying next to nothing, investing in gold and other precious metals looks very appealing. But before jumping in to the market for the shiny stuff, be sure to understand all of the nuances and pitfalls.

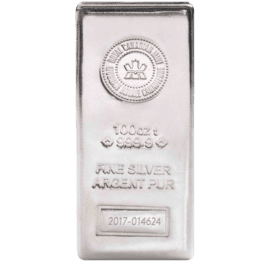

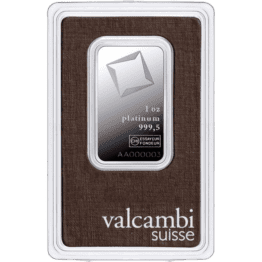

Physical Ownership of Precious Metal Coins and Bullion Tax Implications

For individuals, there are no tax-law restrictions on direct physical ownership of precious metal coins and bullion. Such assets, however, are considered collectibles for federal income purposes. As such, any net long-term capital gains when these assets are sold by an individual taxpayer are subject to a maximum federal income tax rate of 28%, instead of the usual 15% maximum rate on long-term gains.

Here’s how the 28% maximum rate deal works. If you are in the 28%, 33%, or 35% federal income tax bracket, your net long-term gains from collectibles are taxed at 28%. If you are in the 10%, 15%, or 25% bracket, your net long-term gains from collectibles are taxed at your regular rate of 10%, 15%, or 25%.

Storage Issues

The other concern with direct physical ownership of precious metal assets is finding a secure place to store them. Burying them in your backyard is legal but not recommended. Using a bank safe deposit box is another possibility, but obtaining insurance coverage could be problematic. One of the best options is to hire a storage company to hold your precious metal assets. Several companies exist for this specific purpose, including the Delaware Depository Service Company.

Depending on the company, you may be able to have your precious metal assets stored on a fully segregated basis–where you continue to hold title to the assets and they are specifically identified and physically separated from everybody else’s assets. Therefore, you can order your coins or bullion to be delivered to you at any time.

An alternative is known as allocated storage where the storage company basically acts as a custodian by holding precious metal assets that add up to what its customers collectively own. In this case, your share is commingled with all the other customers’ shares, and you only have a piece of paper to show for it. If you demand delivery, it could take some time to convert your share into actual physical coins or bullion that could then be shipped to you.

Whether you choose segregated or allocated storage, make sure to ask about insurance coverage.

The Bottom Line

The important thing to take away from this story is that your profits from taxable investments in precious metal coins, bullion, and ETFs could be taxed at a higher-than-expected rate. That doesn’t make acquiring some of these assets a bad idea, but it’s something to think about before you decide to pull the trigger.