nbcnews.com | By Martha C. White (msnbc.com contributor) updated 5/20/2011.

Consumers head to pawn shops, antique dealers, Tupperware-party-style events.

The great silver rush of 2011 is charging ahead, even though the price of the precious metal has dropped from record highs.

Last month, silver prices skyrocketed to an all-time high of $48 an ounce, causing many Americans to rifle through their jewelry boxes, attics and drawers for old necklaces and other silver trinkets.

Silver is now trading at about $35 an ounce, but with gas and food prices soaring, people still are looking to raise some money by unloading their shiny objects.

Ordinarily playing second fiddle to gold, silver came into the spotlight when the price per ounce hit $25 in late 2010 and continued to soar.

“It’s doubled since last year,” Michael Toback, owner of a precious metals supply house in New York City, says of the number of people bringing him silver they want to sell. Jewelry such as silver chains or charms might yield a few bucks, he says, but the real value is in heavier pieces like sterling silverware, as well as tableware like platters, candlesticks and napkin rings.

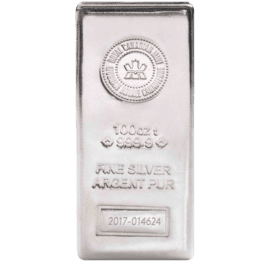

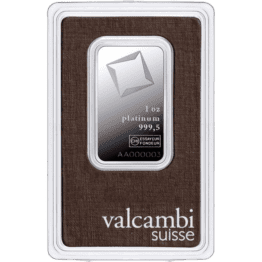

Toback says some of the people selling silver now are those who bought silver coins and bullion the last time the price came close to $50 an ounce back in 1980, only to watch it drop below $5 shortly thereafter. Many others, though, aren’t hobbyist investors, but ordinary people hoping to take advantage of silver’s historically high value.

Many visit pawn shops or antique stores, while others sell their silver items at Tupperware-party-style events, at which guests come in with silver and leave with cash.

Entrepreneur Lisa Rosenthal, owner of a 3-year-old company in suburban Boston that runs gold-buying parties, expanded her business early this year to capture the burgeoning interest in silver. While her associates previously bought silver from event participants as a courtesy, Rosenthal now markets silver-specific buying parties. Since March, Party of Gold’s associates have been booking a couple hundred silver-buying parties each month around the country. “The quantity of silver we receive now is pretty tremendous,” she says.

Dave Crume, vice president of A-OK Pawn and Retail in Witchita, Kan., and president of the National Pawnbrokers Association, says he’s buying a lot more silver these days, a phenomenon which his fellow pawnbrokers report experiencing, as well. “I’m probably seeing a 300 percent increase, at least,” he says.

Crume says people know their silver is worth more than it used to be, but often they don’t have a good sense of how much it’s gone up. “The majority of people are pleasantly surprised” when they find out how much they can earn from a tarnished pitcher or cache of mismatched flatware.

This was exactly what happened to Susan Baker, an accounting manager from Boylston, Mass.. Baker took some of her in-laws’ old silver to sell last month when her husband’s siblings were cleaning out the family home in preparation for putting it on the market. Baker says she had a small assortment of items — a couple of candlesticks, napkin rings, commemorative mugs and around 40 pieces of silverware — and was bowled over when the buyer offered her nearly $1,250 for the collection.

“We knew that silver had some value, but it was a pleasant surprise that it was that much,” she says. “But right there on the spot, she wrote us a check.”

While Baker says her family plans to put their windfall towards a group vacation, other people selling silver are pressed by economic necessity, buyers say. “In some cases, they tell me they’re behind on their mortgage payment,” says Larry Nyborn, co-owner of Precious Metals Reclaiming Service in Westwood, Mass. “I’ve heard that more than once, that’s for sure.”

“For the average person, their silver and gold is one of the few things that has gone up,” says Phil Dreis, owner of the Antique Cupboard in Waukesha, Wis. “They’re facing the problem of more expensive food and gasoline, their wages haven’t gone up and a lot of sources of people’s wealth have disappeared. This is one of the few that’s been a success story.”