Numismatic News | By Pat Heller | July 20, 2015

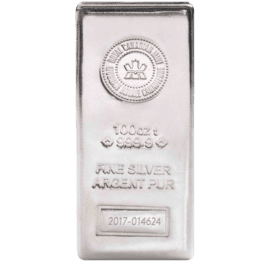

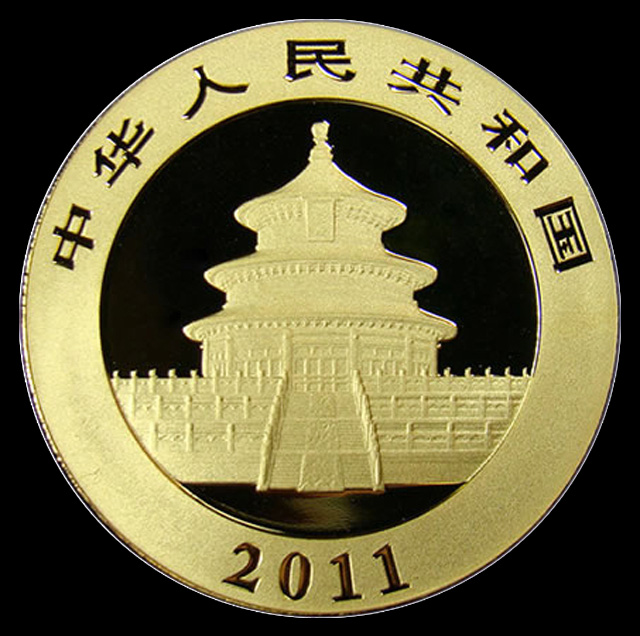

Last Friday, the State Administration of Foreign Exchange (SAFE) of the People’s Bank of China (PBoC) reported that the central bank now had gold reserves of 1,658 tons (53.3 million ounces), an increase of 604 tons from the 1,054 tons (33.9 million ounces) reported in April 2009, with no changes since then.

The new figure was much lower than almost every analyst expected. It is obvious that the PBoC have been misreporting its gold reserves for the past six years, as the announcement included a statement that purchases had been made periodically over the years rather than all being acquired suddenly last week.

Back in 2005, I wrote that China had been surreptitiously acquiring gold reserves since 2003. Not until 2009 did China’s central bank disclose that they had added 600 tons since 2003, increasing stated reserves at the time to 1,054 tons from the previously reported 454 tons. In discussing the April 2009 update, I stated that this figure was almost certainly lower than the accurate total of gold reserves at the time.

As part of the last week’s announcement, the PBOC stated that gold reserves were reported using the International Monetary Fund (IMF) Special Data Dissemination Standard (SDDS) which was already being used by 73 other nations for disclosing their gold reserves. It is widely understood that many or most of the countries claiming to report gold reserves under this standard are still hiding their true reserve totals.

Recently, the Chinese announced that they want the renminbi yuan to be included among the currencies that comprise the IMF’s Special Drawing Rights. The official time for revising the standard occurs in October, but the behind-the-scenes political maneuvering to gain support for this change is done in advance.

In order to become part of the Special Drawing Rights, China must gain support from more than 60 percent of the IMF member nations. It has already far surpassed that threshold. In addition, China would need support from 85 percent of the voting power among the membership. Already, China has lined up support from more than 70 percent of the voting power. The United States by itself holds 16 percent of the IMF voting power, which means that America holds veto power.

There are multiple reasons why China would understate its current gold reserves. It would also be easy for the PBoC to continue to understate its holdings.

First, the newly announced reserves would move China up to fifth place among national central banks in holdings, behind the U.S., Germany, France and Italy. At this level, China could signal its economic clout, but would not yet represent an immediate threat to surpassing the U.S. dominance. Therefore, it is possible that Chinese gold reserves could be understated as a ploy to encourage the U.S. to support adding the yuan to the Special Drawing Rights.

Second, China’s government in general tends to be less transparent to the rest of the world about its true economic power (a practice engaged in by many countries). It would do this in order to be able to exert more influence at strategic points by then revealing higher gold reserves. For instance, some analysts think that the reason the Chinese made their disclosure last Friday was to support the Chinese stock market, where the Shanghai Composite Index is currently down more than 25 percent from its peak last month.

As for being able to underreport reserves, there are several means by which this could be accomplished. The best information I have is that domestic gold mine production is sold to the PBoC, where the country’s gold output is not reported. However, China is thought to be the world’s largest gold producer. Since this data is not officially reported, it would be easy to conceal the increase in reserves.

Also, some nations hide gold reserves in entities such as sovereign investment funds because that is not technically part of the central bank reserves. China could be doing this as well.

Chinese central bank gold purchases actually do not show up anywhere. It does not buy gold through the Shanghai Gold Exchange (SGE), as confirmed last year by an SGE official.

Also, any gold imports on behalf of the PBoC are not reported. There are four categories for classifying gold imports, one of them being “monetary gold.” None of the Chinese gold imports are marked as being monetary gold, though it would be easy to become monetary gold once inside the country.

Last, it is likely that the PBoC has purchased gold reserves that are stored outside the nation’s borders.

Over time, I have found the research of Koos Jansen in Singapore to be the most detailed and persuasive at analyzing the movement of gold in China. He currently estimates that Chines gold reserves are about 13,781 tons, almost 443 million ounces. That indicates a massive 12,000 ton discrepancy to the official Chinese news release. To review his comments about the PBoC Friday announcement, go to https://www.bullionstar.com/blogs/koos-jansen/analyzing-pboc-official-gold-reserves-update/.

I don’t think anyone other than Chinese officials know the actual size of the country’s gold reserves. Before Friday’s announcement, analyst estimates ranged all the way from 2,500 to 30,000 tons. To have the Chinese claim reserves lower than the bottom forecast is an indication to me that they are almost certainly understated. We will have to wait to hopefully get a true picture sometime in the future.

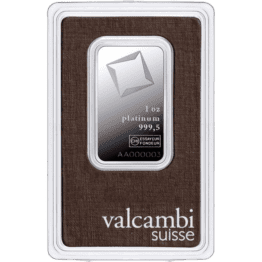

In the meantime, the announcement of lower gold reserves than expected is making it easier for some parties to allege that physical gold demand over the past six years has been much lower than thought. As a result, the price of gold today touched a five-year low. At my company, you couldn’t tell that – no one is selling today and buying demand has gotten even stronger than it was over the past three weeks.

Patrick A. Heller was the American Numismatic Association 2012 Harry Forman Numismatic Dealer of the Year Award winner. He is the owner emeritus and communications officer of Liberty Coin Service in Lansing, Mich., and writes Liberty’s Outlook, a monthly newsletter on rare coins and precious metals subjects. Past newsletter issues can be viewed at http://www.libertycoinservice.com. Other commentaries are available at Coin Week (http://www.coinweek.com).