By Patrick A. Heller | October 29, 2013 | numismaster.com

Last Friday, I delivered a presentation at the 11th annual Silver Summit in Spokane, Wash., titled “Consumer Protection Tips When Buying And Selling Physical Silver.” One of the slides of the PowerPoint presentation had the headline of “Warning Signs Of Dealers You May Want To Avoid.” Many of the points listed also apply to the purchasing of other precious metals and numismatic items.

I’ve given this presentation a few times now and received lots of appreciation from the audience on how to avoid dealers who take advantage of novice customers. On the way home from Spokane, it occurred to me to share some of the items on the list with NumisMaster readers. So, here goes.

You may want to avoid:

Dealers who make unsolicited cold calls. Such callers are not calling you in hopes of the meager profit margins from a competitively priced bullion sale.

Dealers who use “teaser” ads or “bait and switch” tactics. From stories that customers tell us, it is virtually impossible to purchase the advertised bargain, no matter how determined the customer might be.

Dealers who steer customers to leveraged accounts without disclosing the greater risk of loss such accounts entail. Leveraged accounts maximize dealer profits, but are not necessarily suited for most customers.

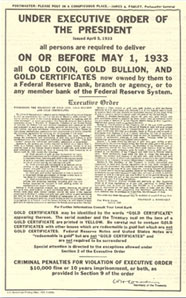

Dealers who try to close a sale using the specter of “gold confiscation.” In 1933, what happened was a 100-percent compensated mandatory gold redemption. There were virtually no reports of the government “confiscating” private gold holdings. Yes, the U.S. government increased the price of gold from $20.67 to $35 per ounce after the redemption was over, but as people turned in their gold they were technically paid “full value” at the time. If a dealer talks about the 1933 gold confiscation, can you trust anything they say?

Dealers who try to steer would-be bullion-priced product buyers into purchasing numismatic coins. This bait-and-switch tactic increases dealer profits but may result in customers acquiring merchandise not suited for their purposes.

Dealers who try to persuade customers to establish a precious metals IRA account. Since Steve Forbes wrote in Forbes in the Oct. 7 issue once again that he expects the U.S. government to seize all private retirement assets (which include precious metals IRAs), a groundswell of investment advisors have started warning their customers of the prospects that this could come to pass within the next two years. Dealers push these accounts because the buyer usually has more funds available in their retirement accounts to make a larger purchase than they do in their non-retirement accounts.

Dealers who only sell, but do not purchase from the public. This is not an automatic warning sign. However, think about it. Dealers want to purchase from the public because they can make a profit when they do so. Therefore, why would any legitimate dealer refuse to buy from the public? I suppose there could be a practical explanation, but consider this to be a warning sign until you get further details.

Dealers who insist on completely avoiding the use of the U.S. post office for sending payments and product shipments. Again, this is not an automatic warning sign. However, a number of scam artists specifically avoid the post office because they don’t want to bring the U.S. postal inspectors down on their operations.

Dealers who offer to break the law (including sales tax laws) in order to make a sale. No explanation needed.

Dealers who are unable to deliver physical product within the 28 days required by the Federal Trade Commission, after which they are subject to additional federal regulations.

Dealers who heavily advertise to sell gold and silver in radio and television commercials, or put large ads in general circulation newspapers and magazines. Almost every time a customer contacts my company to match one of these ads, the truth turns out to be one of three possibilities. First, we have the merchandise in stock and can provide it at a lower price, though not necessarily with the same fancy packaging. Second, the product is not available to other competitors, so the seller can pretty much set whatever inflated price he wants. Third, the seller is either counting on using bait-and-switch tactics to sell more profitable merchandise or he is trying to gather customer names and contact information that can then be rented or sold.

There is one more warning that I did not include in this presentation:

Dealers who offer to sell bullion that will take credit card payments at the same price as other payment forms. For competitively priced dealers, credit card fees usually exceed their profit margins. So, any dealer that accepts credit cards at the same price as cash, checks, and other payments is likely to be a higher-priced seller.

I’m sure that it is possible that there could be an occasional exception where a seller whose business practice is described above may be legitimate and competitive. However, at minimum, you should do additional due diligence before patronizing such dealers. In many instances, to look out for your best interests, all you have to do is contact one or two other dealers to comparison shop.

In my experience, most coin and bullion dealers will go the extra mile to develop long-term mutually profitable relationships with their customers. But, like any industry, there are some bad apples that should be avoided.

I’m sure my list is not complete. Please feel free to add to this list. If you would like to receive a copy of my entire PowerPoint presentation, please send me an email at path@libertycoinservice.com.

Patrick A. Heller was the American Numismatic Association 2012 Harry Forman Numismatic Dealer of the Year Award winner. He owns Liberty Coin Service in Lansing, Mich., and writes “Liberty’s Outlook,” a monthly newsletter on rare coins and precious metals subjects. Past newsletter issues can be viewed at www.libertycoinservice.com. Other commentaries are available at “Coin Week.” He also writes a bi-monthly column on collectibles for The Greater Lansing Business Monthly. His radio show “Things You ‘Know’ That Just Aren’t So, And Important News You Need To Know” can be heard at 8:45 a.m. Wednesday and Friday mornings on 1320-AM WILS in Lansing.